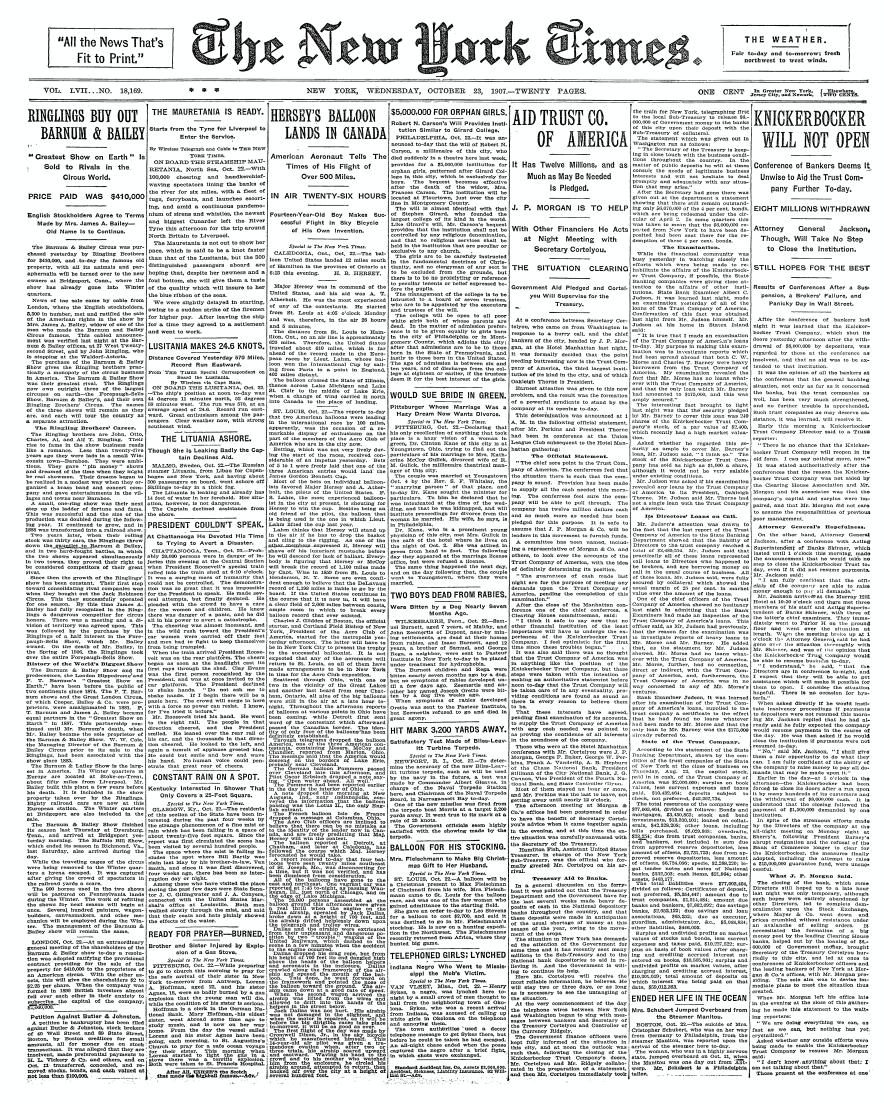

Of course, the real sin here was the Times equating a real news story about the terrifying collapse of a seemingly impregnable financial institution like the Knickerbocker, (see Stanford White's headquarter's building on Fifth Ave for the underlying psychological intent,) along with a second story that appears intended to put to rest rumors that the same thing might happen down the street.

See the rhythmic march across the seven columns of type---with the Hersey's candy and a clown story on the left deferring in reduced letter-faces, with just three sub-headlines, which diminishes the white space that off-sets the terrifying word's impact on the left. If Noah paired animals for a reproductive purpose, then the Times likewise made twins out of these stories.

Now notice the lead article from the day before, whose headline affirms the Knickerbocker Trust company also Will Be Aided. However, 24 hours later this "news" has changed to "Bankers Deem It Unwise to Aid the Trust Company Further Today." In less politically correct terms this might be called Native-American Giving. But would agitated depositors of the Trust Company of America just sit around waiting on Wednesday to also see a proffer of aid reconsidered?

At a benign point in history, between the Indians threatening to scalp colonialists, and the mustard gas of World War I, financial "panics" such as this were employed, in much the same way that present-day "terror" campaigns are utilized. It's a highly effective method because subconsciously we know who the real terrorists are, and their impunity to act frightens us deeply.

Almost five years later this story is getting the Times' knickers in a twist, but not over the Knickerbocker. In "Panic Days Taken Up In The Steel Suit; Oakleigh Thorne Asked About the Run on His Trust Company of America," the Times' editors were forced to revisit what obviously was that era's conspiracy theory, one which also wouldn't go away. For real high dudgeon, read the editorial first:

June 11, 1912, New York Times, Editorial, The Trust Company of America Story

So long as the Trust Company of America continued in business and was striving with encouraging success to repair the disasters which befell it in the panic of 1907, THE TIMES passed by in silence without comment or denial published statements, often repeated, which pointed to a certain news article published in THE TIMES of Oct. 23, 1907, as the cause and beginning of that trust company's troubles. In testimony upon the witness stand and in the columns of our New York contemporaries this view of the matter has often been presented. In one New York morning newspaper the relation of The Times to the run upon the Trust Company of America was very fully set forth some months ago, while its own publication of an article substantially identical with that which appeared in THE TIMES was conveniently glossed over. One of our evening contemporaries, in its financial column, jas often and, as it were, habitually sought to fix responsibility for the run upon the Trust Company of America on THE TIMES. Inasmuch as during the years when this falsehood has been kept alive the Trust Company of America was making hopeful progress in the mending of its fortunes, it seemed to THE TIMES that it would be the part of magnanimity not to make any statements that might call for or provoke a diligent re-examination of the real causes that led to the troubles of that institution. The Trust Company of America having been absorbed by another company, and Mr. Oakleigh Thornes's testimony in the Steel suit yesterday furnishing the occasion, it is now proper that an end should be made of these perversions of fact.

Mr. Thorne testified yesterday to this effect: "I believe this run was "largely attributable to that article in the "New York Times." The article to which Mr. Thorne refers was a statement issued at the conclusion of a conference pf bankers on the evening of Oct. 22, 1907, at which it was arranged tjhat assistance should be extended to the Trust Company of America. In our news columns this morning we present the record evidence showing that this statement was published substantially in the form in which it appeared in THE TIMES, The World, The Tribune, The Press, The Sun, The Herald, and The Journal of Commerce. Why, of the seven newspapers which published the statement, THE TIMES has been singled out to bear the brunt of the offending, if offending there was, is a question which must be left to the judgement of a candid world,

That is not all. The troubles of the Trust Company of America did not begin on Oct. 23, the date on which the bankers' statement was published in THE TIMES and in six other newspapers. On that very day The Tribune, The Press, and The Sun in their news accounts of the trouble in the Street told of a run upon the Trust Company of America beginning the day before, Oct. 22, In some of these accounts it was said that $4,000,000 had been withdrawn, in others the sum was put at $3,000,000. Nor is this all. On the morning of Oct. 24 The Sun published an interview with a Director of the Trust Company of America, given on Oct. 23, in which he said: "We knew when we went to bed last night that almost as sure as shooting there would be a run in the morning." The "last night" of this statement referred to the night of Oct. 22, before the publication of the bankers' statement in THE TIMES and six other newspapers. Not only had the run begun on Oct. 22, but the officers of the company felt certain that it would continue the next day.

We think we may leave this matter here, firm in the conviction that any attempt in future to attribute the troubles of the Trust Company of America solely or chiefly to any publication of THE TIMES of Oct. 23, or any other date, may with entire justice and propriety be put into the category of falsehoods uttered with wicked intent to deceive.

Other evidence also points to the Times' agenda, like the use of what they call "The Official Statement," that hypes a story pretending to deny a trumped-up rumor, (I am not a thespian! How many times do I have to tell you?) while the genuine news of a cataclysm in high-finance gets deflected with wishful thinking:

Oliver J. Pilat, a Director in the National Bank of Commerce, was asked last night by a Times reporter for a statement as to the reasons his bank had for refusing to handle the clearances of the Knickbocker Trust Company yesterday.

"I believe that the notices were sent," he replied, "but I can make no statement to you ro-night."

"Should you have an explanation that would relieve the public in the morning THE TIMES would be glad to print it,” he was told."

Mr. Pilat hesitated a considerable time.

"I can make no explanation now," he said. "All that I will say is that I believe that the notices have been sent."

Oct. 22, 1907, New York Times, Knickerbocker Will Be Aided;

President Barney Quits and Financiers Promise to Support the Trust Company. J.P. MORGAN & CO. HELP Bank of Commerce's Refusal to Clear for the Knickerbocker Precipitates Changes. A.F. HIGGINS NEW HEAD Solution of the Difficulty Reached at a Night Conference -- Trust Company Clearing House to be Formed. Conference at J.P. Morgan's Office. The Knickerbocker Trust Company. A Strong Directorate. Morgan & Co. Willing to Help. Barney and Morse at Odds. Director Pilat Reticent. A Conference at Sherry's. Delays in the Clearings. Changes in the North America. Mercantile Changes. Thomases Out of Consolidated. A Thorough House Cleaning. Getting Rid of Heinze. STATE EXAMINERS AT WORK. Examiner Hutchins Says Mechanics & Traders Is Sound.

Announcement was made late yesterday afternon that Charles T. Barney had resigned the Presidency of the Knickerbocker Trust Company, one of the biggest of the city's financial institutions, and that the National Bank of Commerce had notified Clearing House banks that after to-day it will cease to act as the Knickerbocker's Clearing House agent. Following this came prolonged conferences between the new President of the Knickerbocker, A. Foster Higgins, and other leading trust company and bank officiers, first at J. P. Morgan’s house, Madison Avenue and Thirty-sixth Street, with Mr. Morgan and his partners, and later at Shery’s with the same financiers.

Cash Guaranteed to Knickerbocker.

After last night’s final meeting, which lasted until nearly 2 o’clock this morning, a committee of Directors of the Knickerbocker Trust Company announced that:

"In view of the fact that the position of Mr. Barney,

October 23, 1907, New York Times, Aid Trust Co. of America; It Has Twelve Millions, and as Much as May Be Needed Is Pledged.

J.P. MORGAN IS TO HELP. With Other Financiers He Acts at Night Meeting with Secretary Cortelyou. THE SITUATION CLEARING Government Aid Pledged and Cortelyou Will Supervise for the Treasury. The Official Statement. Treasury Aid to Banks. The Examination. Its Directors' Loans on Call. State of the Trust Company.

At a conference between Secretary Cortelyou, who came on from Washington in response to a hurry call, and the chief bankers of the city, headed by J.P. Morgan, at the Hotel Manhattan last night, it was formally decided that the point needing buttressing now is the Trust Company of America, the third largest institution of its kind in the city, and of which Oakleigh Thorne is President.

Earnest attention was given to this new problem, and the result was the formation of a powerful syndicate to stand by the company at its opening to-day.

This determination was announced at 1 A.M. in the following official statement, after Mr. Perkins and President Thorne had been in conference at the Union League Club subsequent to the Hotel Manhattan gathering:

The Official Statement.After the close of the Manhattan conference one of the chief conferrees, a Clearing House committeeman, said:

"The chief sore point is the Trust Company of America. The conferrees feel that the situation there is such that the company is sound. Provision has been made to supply all the cash needed this morning. The conferrees feel sure the company will be able to pull through. The company has twelve million dollars cash and as much more as needed has been pledged for this purpose. It is safe to assume that J. P. Morgan & Co. will be leaders in this movement to furnish funds.

A committee has been named, including a representative of Morgan & Co. and others, to look over the accounts of the Trust Company of America, with the idea of definitely determining its position.

"The guarantees of cash made last night are for the purpose of meeting any demands upon the Trust Company of America, pending the completion of this examination."

"I think it safe to say now that no other financial institution of the least importance will have to undergo the experiences of the Knickerbocker Trust Company. I feel optimistic for the first time since these troubles began."

It was also said there was no thought that the Trust Company of America was in anything like the position of the Knickerbocher Trust Company, but these steps were taken with the intention of making an authoritative statement before noon to-day that the Trust Company will be taken care of in any eventuality, providing conditions are found as sound as there is every reason to believe them to be.

That these interests have agreed, pending final examination of its accounts, to supply the Trust Company of America with any cash needed was pointed to as proving the confidence of all interests in the soundness of the company.

Those who were at the Hotel Manhattan conference with Mr. Cortelyou were J. P. Morgan, George F. Baker, George W. Perkins, Frank A. Vanderlip, A. B. Hepburn of the Chase National Bank, President Stillman of the City National Bank, J. G. Cannon, Vice President of the Fourth National Bank, and State Controller Glynn.

Most of them stayed an hour or more, and Mr. Perkins was the last to leave, not getting away until nearly 12 o'clock.

The afternoon meeting at Morgan & Co.'s offices had been postponed in order to have the benefit of Secretary Cortelyou's advice when it came together again in the evening, and at this time the entire situation was carefully canvassed with the Secretary of the Treasury.

Hamilton Fish, Assistant United States Treasurer, in charge of the New York Sub-Treasury, was the official who formally greeted Mr. Cortelyou on his arrival.

Treasury Aid to Banks.

The Daily Graphic Expose

The Three Main Articles

March 14, 1874, The Daily Graphic, Page 99, Column 4, Letters From the People. A Life-Insurance-Policy Pawnbroker's Shop,

March 19, 1874, The Daily Graphic, page 135, Column 2, The "Traders' Deposit Company. Is It a Life Insurance Policy Pawnbroker's Shop?

March 23, 1874, The Daily Graphic, Page 163, Columns 3 & 4, A Life-Insurance-Policy Pawnbroker's Shop-Speculating on the Necessities of Embarrassed Policy-Holders--Fifty Per Cent. Per Annum For Loans,

March 14, 1874, The Daily Graphic, Page 99, Column 4, Letters From the People. A Life-Insurance-Policy Pawnbroker's Shop,

(TO THE EDITOR OF THE GRAPHIC.)

Can you give me some information regarding the "Traders' Deposit Company," which has an office at No. 85 Liberty street, and which advertises to "lend money on approved securities?" I am informed that the "company" has a merely nominal capital, and that it is made up principally of the controlling officers of a certain prominent life insurance company; also that the object for which the concern was established is to lend money on the pledges of polices issued by the aforesaid life insurance company. The charter of the latter prohibits the loaning of money on its own policies, and its officers take advantage of the necessities of policy-holders, who are forced to borrow on their policies by sending them to the Traders' Deposit Company. At first blush this may seem to be a fair and legitimate business. But I am told that the moneys advanced by the "deposit" company really belong to the life insurance company; that is to say, the insurance officers deposit their "trust funds" with the Traders' Deposit Company, and the officers of the latter use it in the manner above described. This kind of traffic is said to be very large, and its profits are enormous. Will you not investigate the matter and publish the facts? A POLICY-HOLDER. New York, March 10.

[The above comes to us from a perfectly trustworthy source. Immediately on its receipt we sent a capable commissioner to the office of the Traders' Deposit Company to inquire concerning the charges of our correspondent. The replies of the officer in charge were evasive and unsatisfactory, and it was impossible to ascertain anything beyond these facts: That the Deposit Company was organized under a special charter, granted on April 19, 1871, authorising the Company "to receive or deposit on on pledge or otherwise money, certificates, and evidences of debt or value, and contracts; also, to advance money, securities, and credit on the same at agreed rates of interest." A certificate of the payment of the capital stock of $50,000 in full was bearing the signatures of George W. Campbell, Jr., President; Samuel Hatton, Secretary; Simeon Fitch, K. Boudinot Colt, and Joseph B. Lemaire, acting collectively as trustees of the corporation. February 1, 1873, a second certificate was executed setting forth that after legal notice—given in the most obscure daily newspaper in the city—the corporation had decided to increase the capital stock to $300,000, and that the said $300,000 was subscribed and paid in in cash to the treasurer of the society. Beyond the declaration that all the officers of the Traders' Deposit Society were stockholders, and that Mr. H. B. Hyde, Vice-President of the Equitable Life Assurance Society, was interested in the stock, Mr. Campbell H. Young, the present President, withheld information concerning the connection of the concern with any life insurance company. The refusal to give information regarding the character of the Company's business, or the manner of conducting it, certainly looks suspicious. It is this circumstance which determines us to pursue our investigation. We shall press our inquiries in other directions, and our readers shall know the result. Meanwhile we call upon all persons who have had dealings with the Traders' Deposit Company to give us a brief account of their experience. We do not want their names for publication—only as a guarantee for the correctness of their statements. If any life insurance policy-holders have pledged their policies to the Traders' Deposit Company, let them send us the number, date, and amount of their respective policies.--ED. THE DAILY GRAPHIC.]

March 19, 1874, The Daily Graphic, The "Traders' Deposit Company. Is It a Life Insurance Policy Pawnbroker's Shop?

Further investigation of the organization of the Traders' Deposit Society, No. 85 Liberty street tends decidedly to strengthen the inference drawn by our correspondent in his communication of the 15th instant. The first name on the list of corporators in the charter of the Company is Sidney Ashmore. We have ascertained that Mr Ashmore was formerly established in Wall street as a mining stock operator, but having failed to, became a soliciting agent to the Equitable Life Assurance Society, from which position he passed to that to editor of the society paper, the Protector, and also managed the advertising department. Among the names of the signatures to the certificate of increase of capital stock that was filed at the County Clerk's office February 1, 1873, appears that of Theodore Weston. Mr. Weston was in the engineers' branch of the Croton Aqueduct Department when Mr. Craven controlled the Bureau, and afterward took an office in the Equitable Building, thus joining in to connection with the latter society, which employed him in certain engineering matters. A close business relation between Mr.Weston and Mr. H. B. Hyde, Vice-President of the Equitable, was the result, and the former now has charge of the works on the Equitable Building in course of construction in Boston, and is also one of the auditors of the Society. The certificate of incorporation filed at the County Clerk's office January 6, 1872, is signed by George Wm. Campbell as President of the Traders' Deposit Society. Mr. Campbell is brother-in-law to Mr. Borrowe, Secretary to the Equitable Lite Assurance Society.

Thus far inquiry has failed to develop that any of the co-exploitators of the Traders' Deposit Society are individuals whose resources would enable them to secure a capital such as that claimed to have been paid in full, and that several of their number are merely salaried employees of the Equitable Life Assurance Society, whose Vice-President, Mr. Hyde, is declared, by the President of the Traders' Deposit Society, to be a stockholder in the latter. The above facts by no means exhaust the information we have obtained, and when fully digested all that has come to our knowledge will be laid before our readers.

March 23, 1874, The Daily Graphic, Page 163, Columns 3 & 4, A Life-Insurance-Policy Pawnbroker's Shop-Speculating on the Necessities of Embarrassed Policy-Holders--Fifty Per Cent. Per Annum For Loans,

We publish below two letters selected from several which have been received at THE GRAPHIC office in response to our call for information respecting the Traders' Deposit Company at No. 87 Liberty street. There is no longer any doubt that the concern has been engaged in the abominable traffic of speculating on the necessities of embarrassed policy-holders. The rates of interest charged, if we may believe the statements of our correspondents, are hardly below the charges of the most unblushing pawnbroker, and, as every policy on which a loan is made has to be absolutely signed and transferred, the Traders' Deposit Company seems to be organized for nothing more nor less than the pawning of life insurance policies. To illustrate the modus operandi of the concern, let us suppose the case of a policy-holder in the Equitable Life Assurance Society. He has been insured for several years and has paid altogether the sum of $800 in annual premiums. He finds himself suddenly embarrassed and must raise a few hundred dollars to discharge a pressing indebtedness. A poor man, he has nothing which be can give as security except the policy on his life. In this emergency a friend tells him that he can go to the company which issued his policy and arrange for a loan. The suggestion is timely; it had not occurred to him. On visiting the magnificent offices of the company, he is politely informed that the company's charter forbids the making of loans on policies, but that the Traders' Deposit Company will probably accommodate him, and at the same time he receives a card containing the following :

TRADERS' DEPOSIT COMPANY,

87 Liberty street,

New York.

Money Advanced on Good Securities of Every

Description.

Loans on Life Insurance Policies.

Seventy-five per cent. of the surrender value loaned on life insurance policies in the best companies.

The office of the Traders' Deposit Company is conveniently located within a few steps of the Equitable's towering edifice, and thither our straitened applicant presses his foot steps. The attendant clerk receives him kindly, and, after a little hasty figuring informs him that the "surrender value" of his policy (that is, the amount which the company issuing it would pay for its surrender) is exactly $400, or one-half the sum total of all the premium payments. "Our rule," the clerk declares," is to loan seventy-five per cent. of the surrender value. We can let you have $300, less ten per cent, as our commission. Then for every month that you retain the money we shall charge $--- as interest, payable when the loan is taken up." The poor man, distressed for the want of money, is only too eager to accept the loan without noticing the hard conditions with which it is coupled. Neither does he notice the fact that he is required to sign a document absolutely alienating his interest is the policy. The foregoing, doubtless, will serve as a fair illustration of the experience which thousands of needy policy-holders have undergone during the past year. The loaning of money on life insurance policies, when effected under fair and honorable conditions, is perfectly proper, and oftentimes is of great benefit to policy-holders. But when it is coupled with the exaction of an enormous rate of interest, when it is carried out in such a way as to induce almost inevitably the forfeiture of policies without any adequate consideration for their surrender, and when the machinery for compassing these detestable objects is under the control and in the interest of two or three grasping life insurance officers, then the whole business is degraded to the meanest kind of pawnbroking and requires to be arrested by indictment. We have taken up this inquiry in the interest of life insurance policy-holders (of whom there are not less than 100,000 within twenty-five miles of the City Hall), and we intend to collect all the information that can be obtained regarding the nature and extent of the business, now openly practised in this city, of loaning money upon life insurance policies. There may be other concerns similar to the Traders' Deposit Company, but it is due to the life insurance companies to say that, that is the only one which is reported to us as having any connection with any particular life company. Doubtless the Traders Deposit Company loans on the policies of other companies than the Equitable; but that is a matter which the companies cannot prevent or even discountenance.

While we are pursuing our inquiries, we particularly desire all persons who have bad dealings with the Traders' Deposit Company to come forward and relate their experiences. Their names will be required only as a guarantee of good faith, and not in any case will they be divulged.

The following are two letters already received:

(To THE EDITOR of THE GRAPHIC.)

I have read an article in your issue of Saturday last, headed "A Life Insurance Policy Pawnbroker's Shop," and as you ask for information relative to their method of transacting business, I send you these few lines.

Having had occasion to make use of some money, and not having anything to use as security, and seeing the advertisement of the Traders' Deposit Company on Liberty street, I took with me my life policy on the best company in New York. After I had made known my wants to the managers of the concern they produced some papers which had to be signed and sworn to. The signing of those papers completely transferred the policy to the officers of the concern in case of non-payment of the interest! The commission for obtaining the money was 10 per cent, cash, and 3% per cent, per month interest, or the sum total of $150 per year on a loan of $800. Now, Mr. Editor, what do you think of this? Is it lawful to clear $150 per annum interest on $800? If you require, I will at some time, when my convenience admits, call on you and have an interview on this subject.

A VICTIM TO SHYLOCKS. New York, March 30.

(To THE EDITOR OF THE GRAPHIC.)

I am glad to see that you are probing into the affairs of the Traders' Deposit Company for the benefit of the public. Some time since I received their card, with my full name and address. As I am a modest man it puzzled me then, and has often since been in my mind. How did they know me? It is clear now as the noonday sun, I am a policyholder in the Equitable Life Assurance Society. What more natural than that, the same people being interested in both concerns the books of one should be open to the other? Thank fortune, I am not so impecunious as to be obliged to spout my life policy, even with so good a concern as the "Trader's," though it is run on an "Equitable" basis.

New York, March 20. G. W. P. D

November 15, 1907, New York Times, C. T. Barney Dies. A Suicide: Ex-President of Knickerbocker Trust Co. Shoots Himself In His Home.

DIES UNDER OPERATION Wound in the Abdomen Was Inflicted at 10 o'Clock Yesterday Morning. HIS WIFE HEARD THE SHOT And Found Him, Wounded, In His Room -- Coroners' Physician and Family Doctor Suggest Accident.

Charles Tracy Barney, who was recently forced to retire from the Presidency of the suspended Knickerbocker Trust Company and was interested in thirty-three other corporations, many of them financial, died at his home, 101 East Thirty-eighth Street, at 2:30 o'clock yesterday afternoon of a pistol wound, self-inflicted some four hours previously in his bedroom there.

October 22, 1907, Associated Press / The Daily Ardmoreite, Uneasiness in Wall St, Developments of Knickerbocker Co. Causes Stir.

Resignation of President Charles T. Barney, Head of Big Institution Tenders Resignation.

Bank Declines Clearing House Agency.

New York, N. Y., Oct. 22.---There is considerable nervousness today in financial circles, concerning the Knickerbocher Trust company.

The news that the National Bank of Commerce had given notice that it would decline to act as the clearing house agent for the Knickerbocher Trust company, and the resignation of Charles T. Barney of the presidency of the latter institution, solved to unsettle sentiment more than the Morse-Heinze development of last week. The magnitude of the business transacted by the Knickerbocher Trust company, with its deposits of more than sixty millions of dollars, gave a much more serious aspect than the changes made in the relatively more smaller Morse-Heinze concern.

The announcement of Mr. Barney’s resignation was followed by a series of conferences by prominent financial men, which lasted until 2 o’clock this morning. J. Pierpont Morgan took a very important part in the discussion. When the meeting broke up this morning, the directors of the Knickerbocher Trist company issued a statement, in which it was stated that Mr. Barney’s outside interests having become greatly extended, in particularly because of his connection with some of Morse’s companies, he had decided that the best interests of the company would be subserved by his resignation from the presidency of the Knickerbocher, although he had no loans with that company, and that he would also resign as one of the directors of the Knickerbocher Trust company, as well as director of the National Bank of Commerce.

It was stated also that in view of the fact that the Knickerbocher Trust company will hereafter clear by itself, that it is deemed advisable to obtain guarantees of additional cash which have been obtained, and the Knickerbocher will be amply prepared to meet any emergencies that may grow out of the change in methods of clearing.

The Knickerbocher has in its own vaults eight millions in cash. If more cash is needed it will be immediately forthcoming.

The stock market opened this morning in a demoralized condition. There was heavy selling and a run of considerable proportions on the various offices of the Knickerbocher Trust company. Prices broke wildly on the opening transactions, but immediately rallied.

Cortelyou Aids Bankers, by Associated Press.

Washington, D. C., Oct. 22.---Secretary Cortelyou declined today to discuss the New York Situation.

It is understood he has ordered sixty-seven million dollars to be distributed among the leading narional banks of New York City.

Conditions at Kansas City, by Associated Press,

Kansas City, Mo., Oct. 22.---Financial conditions in Kansas City are healthy according to leading bank officials here,

Wm. A. Roule, cashier of the National Bank of Commerce of Kansas City, which has deposits of thirty-five millions, said today to the Associated Press:

“We might say we have had unusual conditions. We are running on conservative lines. Any unusual conditions in New York is felt in the West, but we have every faith in the New York banks being able to handle the situation there.

“West of us and tribuatry to Kansas City the conditions have been unusually prosperous and the country banks have plenty of money.”

America’s Development In Agricultural Way Most Marvelous in History.

Fine Crops in the West,

Member of Interstate Commerce Commission Reaches Washington From Tour of Country---California’s Fruit Crop.

Ardmoreite Special.

Washington, D. C., Oct. 22.---“Nobody can appreciate how this country is booming until he travels over it and talks to the people. America’s development in agriculture and every sort of industrial pursuit is the most marvelous in history. I thought a few years ago we had attained the height of our prosperity but if a man had predicted a decade ago what the American people now are actually experiencing in a commercial way it would have been said of him that he had what the late senator from Kansas, John J. Ingall’s, described as an “irredescent dream.”

Hon. Franklin K. Lane, the Pacific coast member of the interstate commerce commission made the above quoted statement upon his return from the far West, where he went to conduct some investigations for the commission and to attend to some private business.

“Naturally,” continued Commissioner Lane, “my mission brought me directly into contact with the great railroads and large commercial and industrial organizations. I had rather exceptional opportunities to find out just what is being done. I was surprised---and it takes something out of the ordinary to surprise me. I had known that an immense amount of business was being done, not only by the railroads, with which I am officially in touch, but by the people generally; but I had no realization or appreciation of the true situation. A few months ago, we were told that the cold spring had destroyed practically the pros[ect for big crops. This was a discouraging statement to agriculturalists, to railroad men and to all other people. The fact is, the crops are fine. Bigger crops of some kinds of grain have been raised in this country than we have this year, but they are almost up to the standard in quantity and they are very superior in quality. In my own state of California we never have had bigger or better crops than we have this year. Our fruit crop, particularly oranges, grapes and apples, is phenomenal. The result is an extrava-ordinary demand for shipping facilities, which the railroads are doing their best to meet. Notwithstanding a large increase in equipmment, made by nearly every one of the western roads during the past year, the railways are simply overwhelmed by the traffic.

No comments:

Post a Comment